Blockchain for Digital Advertising: Lots of Potential but Who Wants to Be the Chicken (or Egg, Whichever Comes First)?

Reposting a piece written a while back in 2017, but still relevant so long as Google, Facebook, and Amazon ads are still in business

At the end of 2017 when everyone was eyeing the soaring bitcoin price, I became interested in its underpinning technology: Blockchain. Having just joined Deloitte Consulting then, I thought participating in the TMT innovation challenge might be a good way to break into the Tech sector network. After weeks of research on both the AdTech ecosystem and Blockchain feasibility, I joined the competition with a Blockchain-based Ad Network solution to disrupt the digital advertising industry. While in hindsight, it’s highly unlikely for any standalone solution to truly disrupt the highly complex, sophisticated programmatic advertising ecosystem, especially with the Facebook-Google duopoly and Amazon’s rise in dominance, in the same way that Apple disrupted the Mobile industry, my attempt to build a Blockchain “panacea” to address AdTech pain points made me the “to-go” person at Deloitte for Blockchain’s use cases in digital advertising.

Since then, I developed numerous PoVs (point-of-view) and PoCs (proof-of-concept) for Fortune 50 companies, including recommending Facebook to tokenized, followed by the Libra announcement a year later.

In this article, I will share my takeaways on Blockchain’s potential in the Digital Advertising space in a pragmatic sense, as most articles in my research have been rather conceptual, focusing mostly on the tantalizing benefits of AdTech on Blockchain, but not how to get there.

Part one: my conclusion about blockchain’s potential to disrupt the Digital Advertising space

In short, I do believe that Blockchain has the potential to revolutionize programmatic advertising by enabling traceability and verification to create transparency in Ad performance. But in reality, it faces a “chicken or egg” dilemma: data from all actors in the ecosystem needs to be “on-chain” to fulfill Blockchain’s promise to provide visibility into an ad campaign’s internet journey, but who want to be the first adopter if there is little near-term economic return with a huge dependency on others in the ecosystem to jump on the bandwagon?

Let me explain, starting with the industry pain point. In my mind, the lack of transparency in digital advertising is the most prominent root cause plaguing advertisers and publishers in the forms of fraud (costing the industry $11Billion alone in 2018 and projected to reach $44Billion by 2022), opaque ROI, dubious ad placements (especially given recent events), and more. Even though Google and Facebook are doing a good job tracking conversions via tagging within their respective universes (accounting for 51.3% global market share), there is still 26.6% of the global digital ad market in which advertisers have little visibility into their ad campaign’s holistic journey among as many as 23 digital ad ecosystem participants, such as myriad DSPs, creative optimizing, media planning and attribution, retargeting, exchanges, SSPs, publisher tools, DMPs, etc..

Because of the complex, multi-party nature of the programmatic advertising industry, advertisers’ ad campaign data is scattered across numerous players, posing immense costs and efforts to piece data from disparate sources to understand customers’ interactions with an ad campaign — if attenable at all.

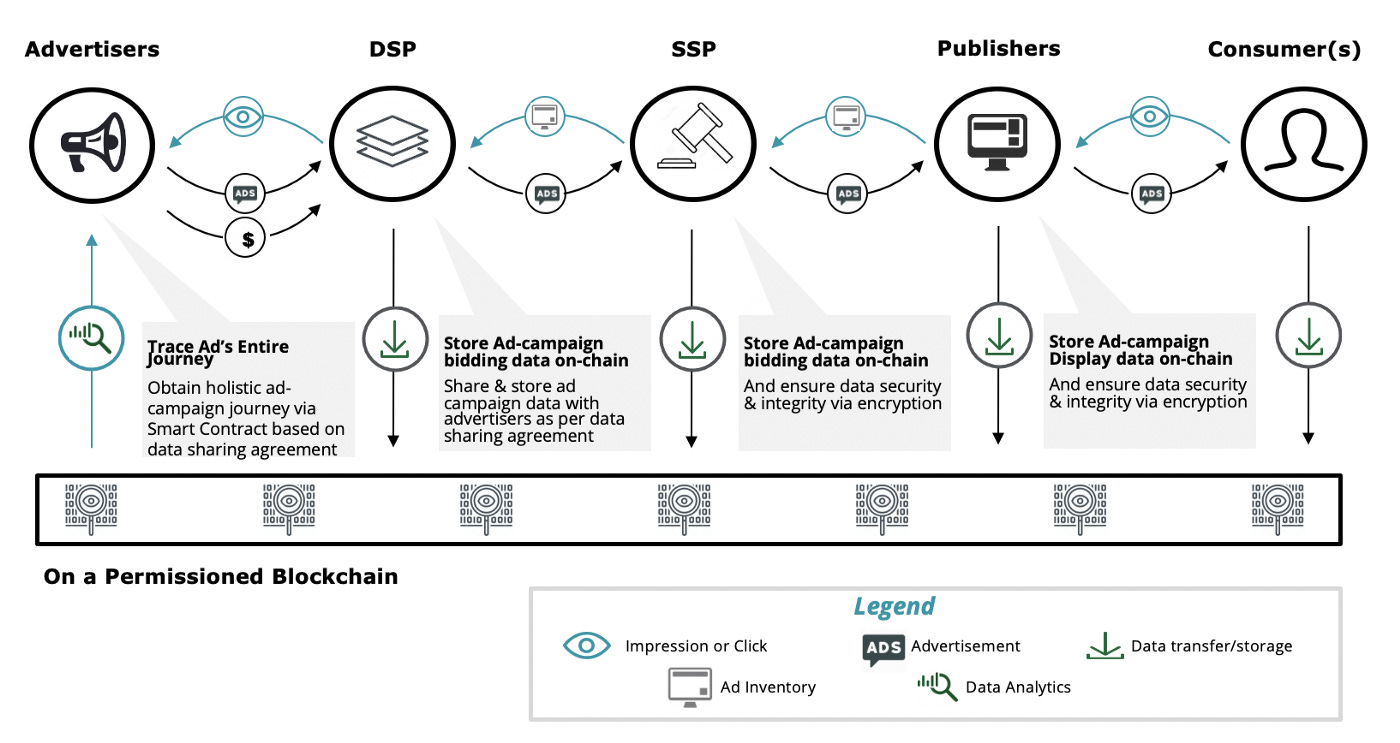

And here is where Blockchain can be the cavalry, as illustrated in the conceptual diagram. Imagine a world where all participants upload the “essential” data, that is, the minimal amount of data needed for advertisers to understand campaign performances as agreed per industry protocol, on a permissioned blockchain. The transfer, upload, and storage of such “essential” data would be self-executed by smart contracts based on multi-party agreements, universally accessible by those permitted (such as advertisers), and securely encrypted against data breaches. In this Blockchain-enabled utopia, advertisers can monitor and verify the entire journey of their ads in near real-time, equipped to perform all kinds of advanced analytics to optimize targeting, dispute fraud payments, and continuously improve their campaigns.

“That sounds great! Sign me up please,” says… no one. The adoption of the blockchain solution presents a classic “chicken-and-egg” dilemma. The ecosystem is so decentralized and disparate that few companies are incentivized enough to

invest millions to build permissioned blockchain infrastructure

contact thousands of advertisers, DSPs, SSPs, networks, agencies, etc.. to negotiate term sheets, onboard them onto the permissioned blockchain, and provide tech support for ongoing blockchain-related issues

allocate dedicated resources and budget to continuously manage the blockchain infrastructure and ongoing responsibilities.

Additionally, non-advertiser participants such as the DSPs, SSPs, and networks seem to be doing just fine. After all, their risk exposure to fraud costs is low compared to the advertisers.

Without the initial infrastructure setup, participant onboarding, and bootstrapping, no one reaps the true benefits of such blockchain solutions, but without sufficient incentives, who wants to be the avant-garde?

So here comes the million-dollar question: who wants to be the chicken (or egg, but my money is on the chicken)?

Part two and part three coming soon.

Part two: My observations on blockchain startups in the AdTech space, and recommendations based on my experience co-founding Deloitte’s blockchain venture to scout & screen startups and enterprises for go-to-market partnerships

Part three: Opportunities for big tech to grab additional Ad market share with an ecosystem-driven strategy supplemented by the Blockchain technology