All you need to know about the Fat Protocol debate, and why I still stand with it

Yes Fat Protocol is still relevant today, and here's why, along with a TLDR of Fat Protocol debate by Jason Choi, Chia Jeng Yang, and the OG Joel Monegro

As many of you know, one of the most anticipated panels at the Penn Blockchain Conference 2023, "Value Accrual in Web3: A Refresh on Fat Protocol Thesis," will gather the leading thinkers on web3 value accrual to debate such a directional topic in person at the Penn Blockchain Conference on 2/10, featuring:

Joel Monegro, GP at Placeholder VC (who coined the term Fat Protocol in his original thesis while at USV)

Aleks Larsen, GP at Blockchain Capital

Jason Choi, Co-founder at Tangent, founder at Blockcrunch

Chia Jeng Yang, Investor at Pantera, and author of Cracks in the Fat Protocol Theory

moderated by myself.

Value accrual has been a long-term topic of interest since I started in web3 VC in 2021, and it's a dream come true to have assembled the four leading thinkers to riff on the topic live on stage.

Ahead of the conference, I revisited the writings of our panelists on the topic and summarized them into a one-pager primer of “All you need to know about Fat Protocol Thesis to date.” In addition to what’s already been argued by Jason, Chia, and Joel (and you can find the summary of their main points at the bottom).

Why I Stand with Fat Protocol in 2023:

Definitions & Assumptions

The definition of what constitutes a "dapp" versus a "protocol" has become increasingly blurred and is no longer as clear-cut as before. Examples of this include:

Middleware or development platforms such as Lens Protocol (which builds on a base layer/Polygon and AR but still serves as a developer platform to attract other dapps to build on top).

App chain thesis (Cosmos 2.0, Avalanche Subnets, Filecoin ICP): the idea of dapps and chains merging, potentially leading to convergence on value accrual.

If a dapp launches its own token, does it become a protocol? What if this dapp becomes a developer platform (like Lens) that others can build on top of? Is it a protocol then? Or does a dapp only remain a dapp if it accrues value to equity, i.e., token?

The corollary is a debate over whether value accrual should happen on the equity vs. token side, and whether or not dapps should tokenize. This warrants a whole separate debate, but for app chains & "rightfully tokenizable" dapps, value accrual should accrue to the token and the token only to align the incentives of investors, the community, and the founding team - hence, Fat Protocol wins here.

Aggregator Theory’s Applicability to Web3 (per JV from Protocol Labs)

Per the aggregator theory (credit to JV of Protocol Labs for pointing it out), whoever owns the relationship with users has the ultimate power to monetize and accrue value (e.g., WeChat, DYDX). Along these lines, I support the Fat Protocol Thesis as an investment approach because Dapps will eventually want to become protocols or their own chain, if not start with it.

Once a Dapp garners sufficient user reaction like DYDX, it will want to become a "protocol" to:

Enter into an ecosystem play by encouraging other Dapps to build on top of it and capture additional fees (thus kicking off the positive feedback loop mentioned by Joel in his original thesis).

Have full control over activities on its own app chain, rather than having gas fees affected by other Dapps' activities on the chain.

Cater to its own use-case-based idiosyncrasies.

Exit Horizon (Investor Angle)

To put on my VC hat and prioritize the fiduciary duty to maximize returns to LP within the shortest amount of time (assuming a close-ended fund), Fat Protocol wins again. The obvious assumption here is that:

Protocol = liquid token readily available on the secondary market, which also means if a dapp has tokenized, it becomes a "protocol" and hence falls under this bucket

Dapps = yet-to-be TGE applications on the primary market

I've long argued that in a bear market, it makes a ton of sense to purchase liquid tokens and long them as venture investments for four reasons:

Lower product risk: You already know more or less what the product is and whether it can successfully launch.

Flexible exit route: Usually, liquid token purchases have a much shorter, if any, lock-up period compared to SAFE deals (need to exit through IPO or M&A) and SAFT deals (with uncertainty around the success of tokenization and additional lock-up period on top).

Low touch compared to SAFE/SAFT: Generally speaking, good investors tend to be more hands-on with venture deals (SAFE/SAFT) than with liquid token deals, as the latter tend to be more mature and require less handholding. If a VC runs a small shop with limited bandwidth, liquid token might be the more tenable route.

Liquid tokens aren't necessarily more expensive than SAFE/SAFT: Unless a venture deal project is raising at a sub-20 valuation, there are many liquid token alternatives under 100M FDV for purchase at the moment with minimal lockup.

In all fairness, evaluating SAFE/SAFT deals against straight-out liquid tokens using the same criteria is not the best practice. If everyone uses the above four criteria to evaluate startups, no venture deals will be done, and in the future, there will be no new tokens. After all, you can have a ton of failed tokens on the liquid market and have un-launched tokens in high-growth green-field new sectors (like MEV, ZK). Ultimately, it will have to return to the fundamental analysis around the growth and adoption of the project and its value accrual (hey full circle, back to Fat Protocol again)!

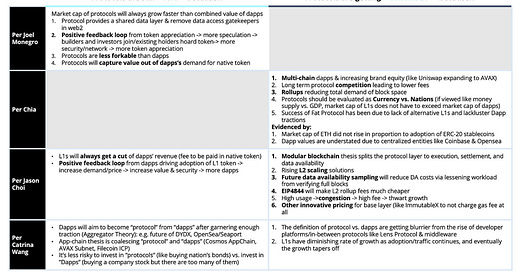

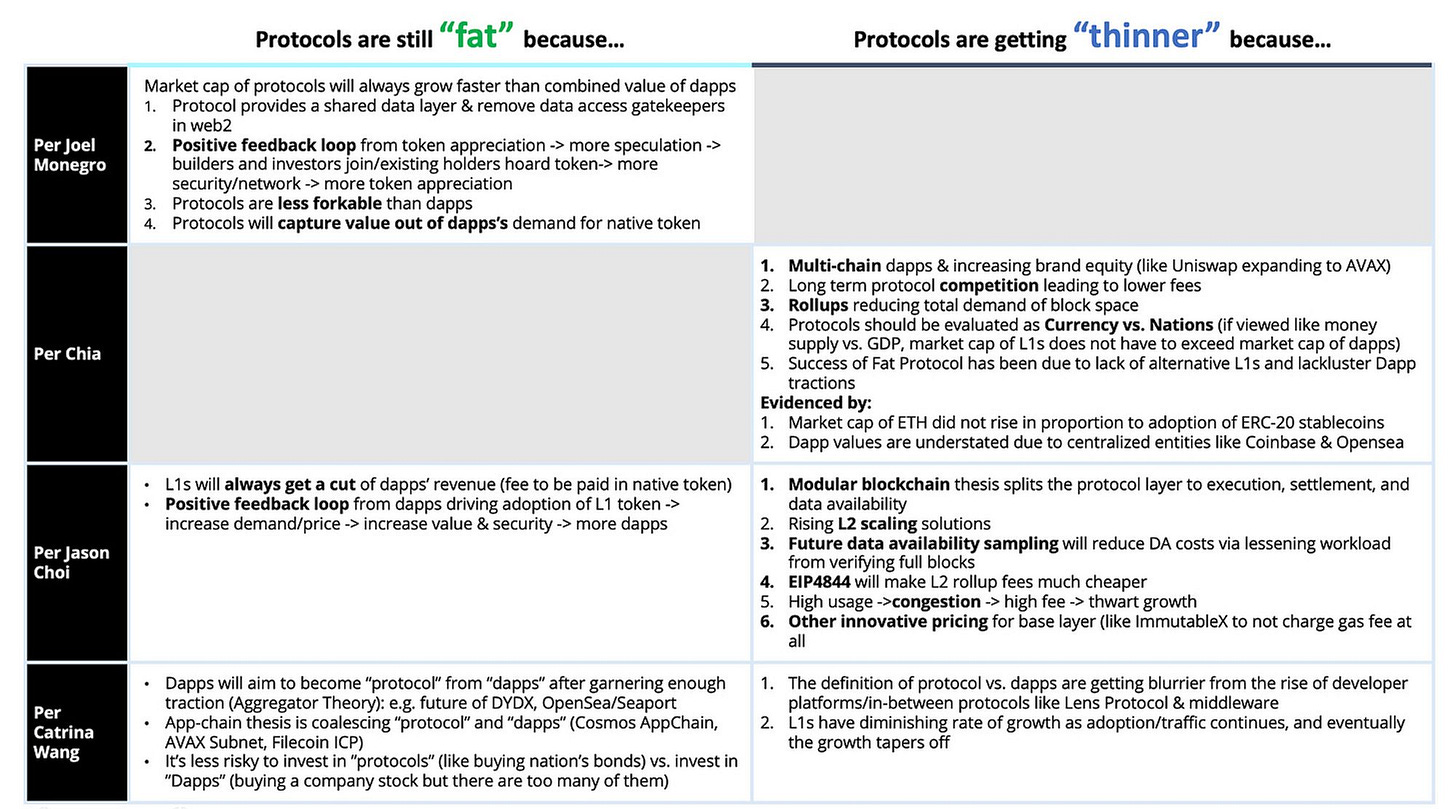

TLDR-ing Fat Protocol debate to date

Original Fat Protocol Thesis

by Joel Monegro, written in Aug, 2016

The market cap of protocols will always grow faster than the combined value of dapps because

Protocol provides a shared data layer & remove data access gatekeepers in web2

Positive feedback loop from token appreciation -> more speculation -> builders and investors join & existing holders hoard tokens-> more security/network -> more token appreciation

Additionally, protocols are less forkable than dapps, and protocols will capture value out of dapps’s demand for native tokens

The Case for Cracked Fat Protocol Thesis

by Chia Jen Yang, written in Mar, 2022

Evidenced by the dampened magnitude of the increase in Eth’s market cap compared to those of ERC20 stablecoins, Fat Protocol is getting invalidated because of

Multi-chain dapps & increasing brand equity (like Uniswap expanding to AVAX)

Long-term protocol competition leads to lower fees

Rollups reduce total demand for block space

Protocols should be evaluated as Currency vs. Nations (if viewed like money supply vs. GDP, market cap of L1s does not have to exceed the market cap of dapps)

The success of Fat Protocol has been due to a lack of alternative L1s and lackluster Dapp tractions

Dapp values are understated due to centralized entities like Coinbase & Opensea

Forget Fat Protocols

by Jason Choi, written in Jan, 2023

The era of Fat protocol & monolithic blockchains may be over as web3 transitions to a modular architecture that separates execution, settlement, and DA layers to compete for fees. Specifically,

Modular blockchain thesis splits the protocol layer into execution, settlement, and data availability

Rising L2 scaling solutions curtail value accrual to base layer

Future data availability sampling will reduce DA costs via lessening workload from verifying full blocks

EIP4844 will make L2 rollup fees much cheaper

High usage ->congestion -> high fee -> thwart growth

Other innovative pricing for base layer (like ImmutableX to not charge gas fee at all

Below are the high-level topics I plan to ask the panelists

Definition of dapps vs. protocol in recent days

How will a modular future of blockchain change the thesis

Where does the App Chain Trend fit into the Fat Protocol thesis

Given the rise of new alt L1s, what are the true moat, or scarcity of a L1 that makes it valuable and hard to replace?

Do you think the base layer winner has emerged yet?

Alpha Leak